single life annuity vs lump sum

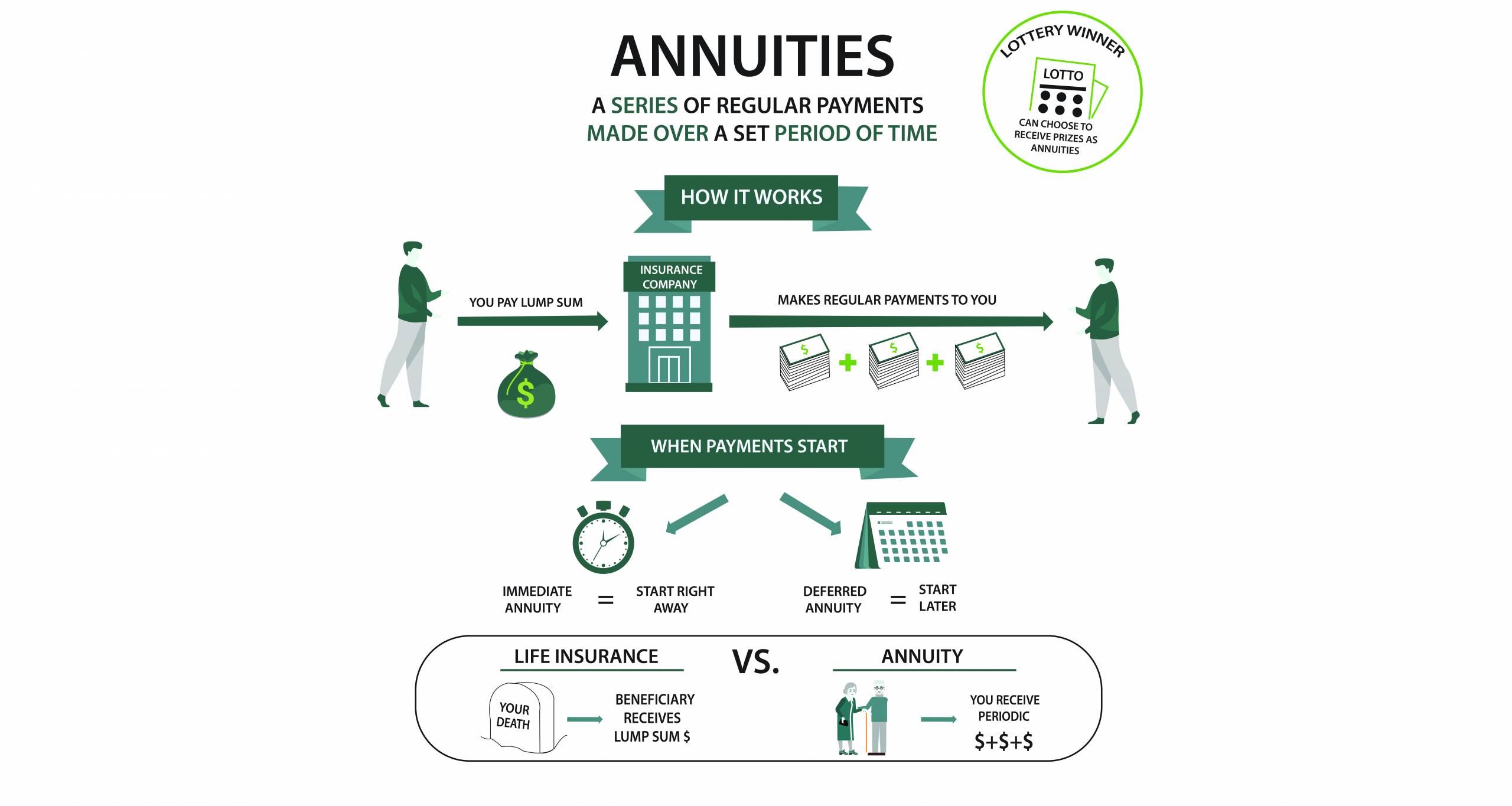

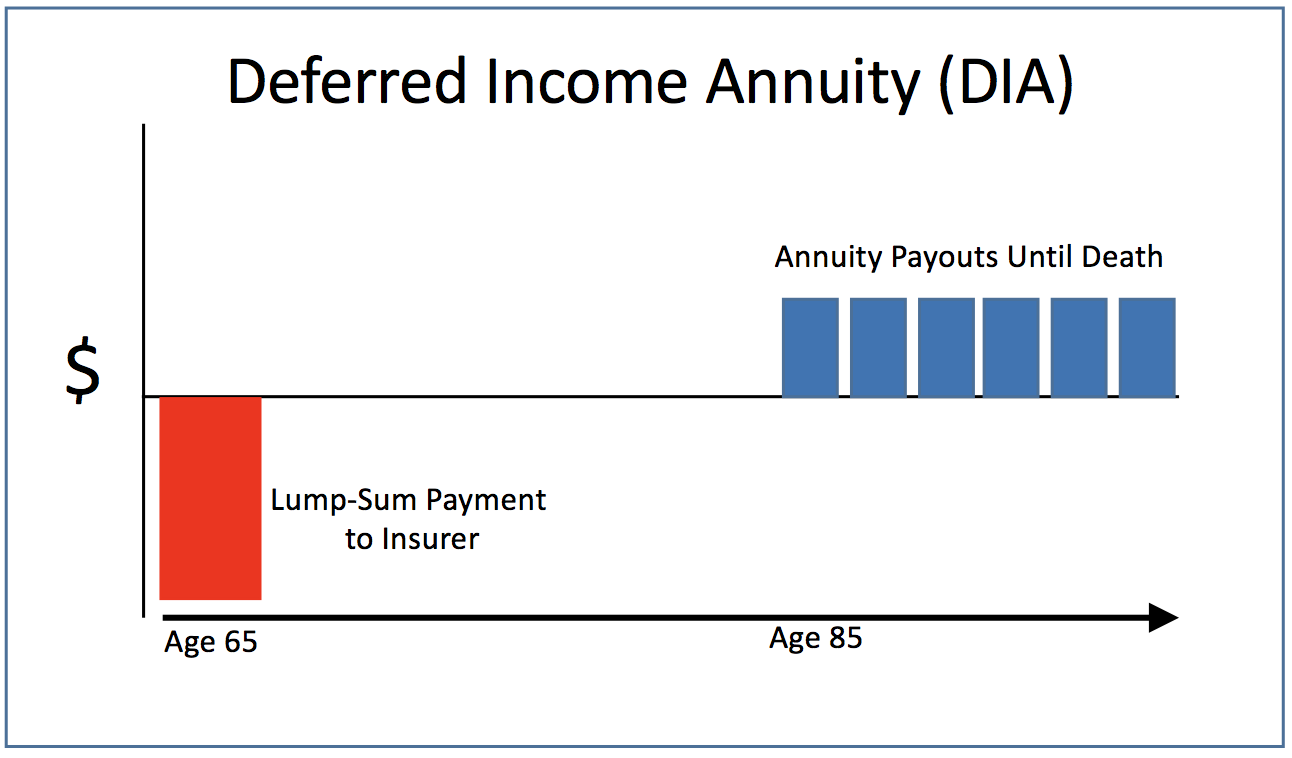

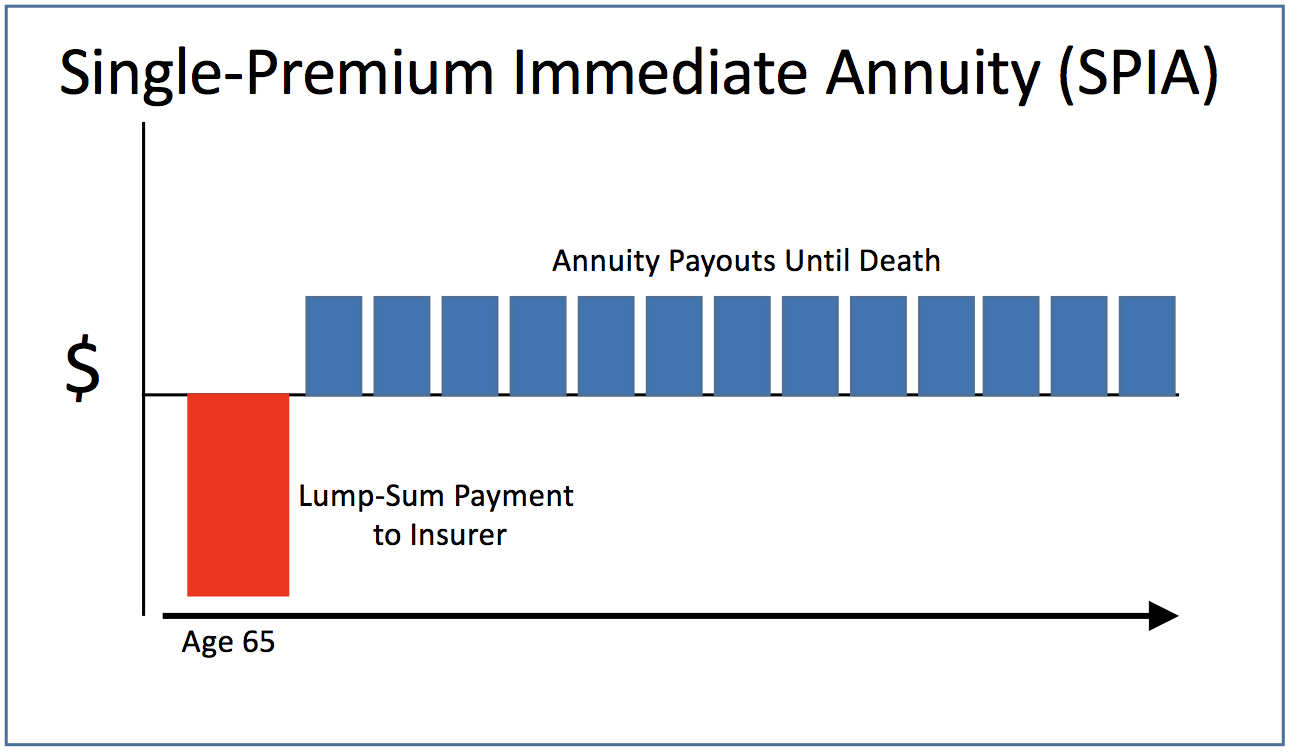

A Single Premium Immediate Annuity sometimes referred to as an SPIA may be the right annuity for you if you are looking for payments that begin right away and continue for the rest of your life or for a specified period of time. The accumulation annuitization and payout phases.

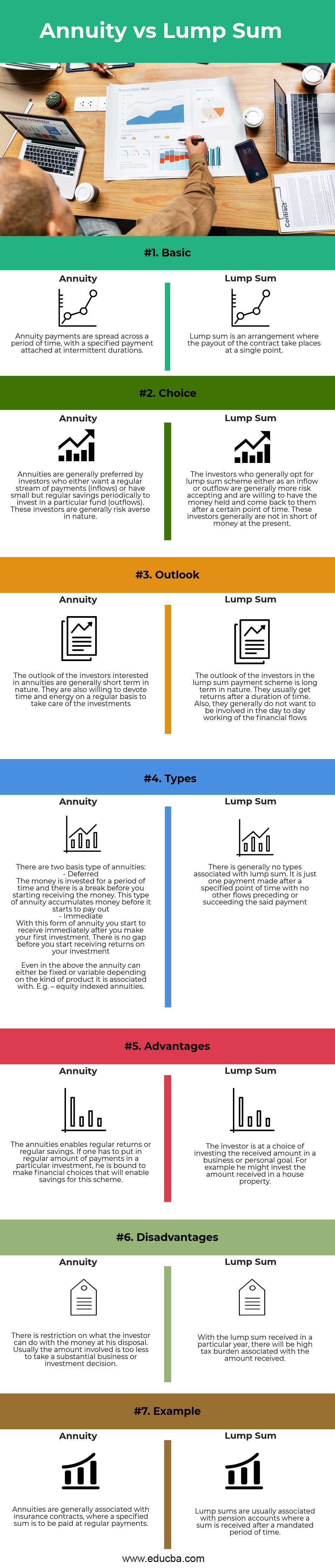

Annuity Vs Lump Sum Top 7 Useful Differences To Know

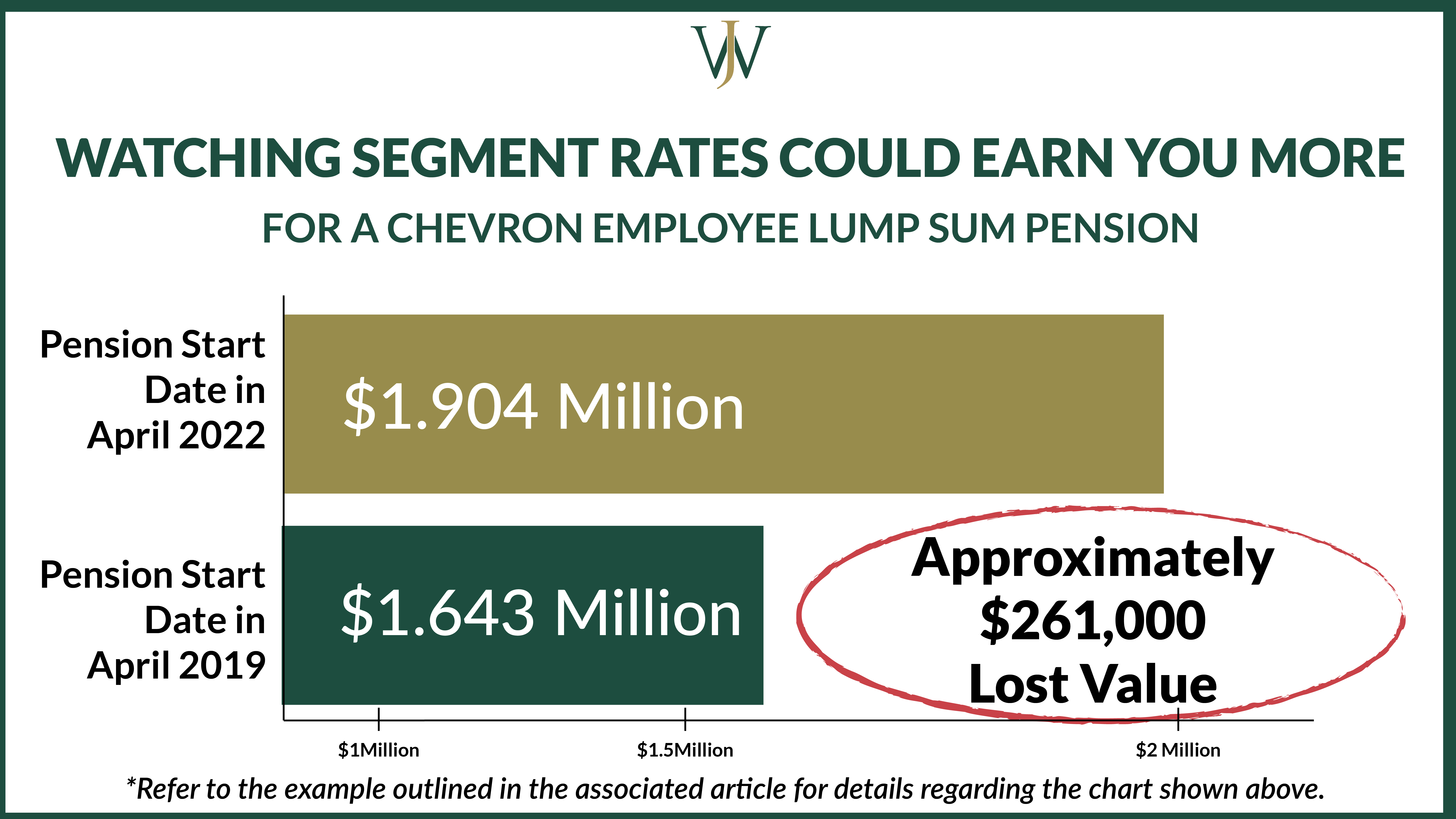

Pension annuity almost always provides a higher annual amount versus what you would receive if you purchased a retail annuity with the lump sum.

. The most significant drawback is that immediate annuities are irrevocable. Subject to policy being in force and all due premiums being paid. If you choose annuity payouts the first thing to consider is paying the taxes.

The pool of funds is invested on the. Did you know that the biggest jackpot a single winner received was in MegaMillions. Available only under Life Annuity with Return of Purchase Price on diagnosis of Critical Illness option.

As the name suggests lump sum payouts mean that your winnings will be given out as a single cash transfer as opposed to annuity payouts where payments are made over time. Lump Sum VS Annuity. Annuity Inheritance Payout Options.

Unlike some other options that allow for beneficiaries or spouses this annuity is limited to the. This annuity is usually purchased by married couples and can provide income for two people with payment based on the lives of both the owner and spouse who is the joint annuitant. The lump-sum payment option allows annuitants to withdraw the entire account value of an annuity in a single withdrawal.

The annuity is purchased from an insurance company with a single lump sum amount called a premium. Minimum 105 of the Single Premium shall be paid. The main difference between a lump-sum and a monthly payment is that with a lump-sum option you get to have control over how your money is invested and what happens to it once youre gone.

A single ticket small enough to get lost in your wallet or purse can change your world forever. It helps you to get a regular payment for life after making one lump sum payment or a series of. Each annuity in this series comes with a death benefit equal to the full value of the contract in a lump sum.

If you inherit an annuity you have four ways to get the money. It isnt much of a surprise then that most winners tend to go for the. Joint and Survivor Annuity.

Lottery lump sum vs. There are several phases in the life of an annuity. To put it another way lump sum payouts allow you to get full immediate access to your winnings.

The guaranteed prize fund is 40 million and the reward can only increase. Neither New York Life Insurance Company nor its. Choose from pensions that are for a single life Joint and survivor or a life with 10 years certain.

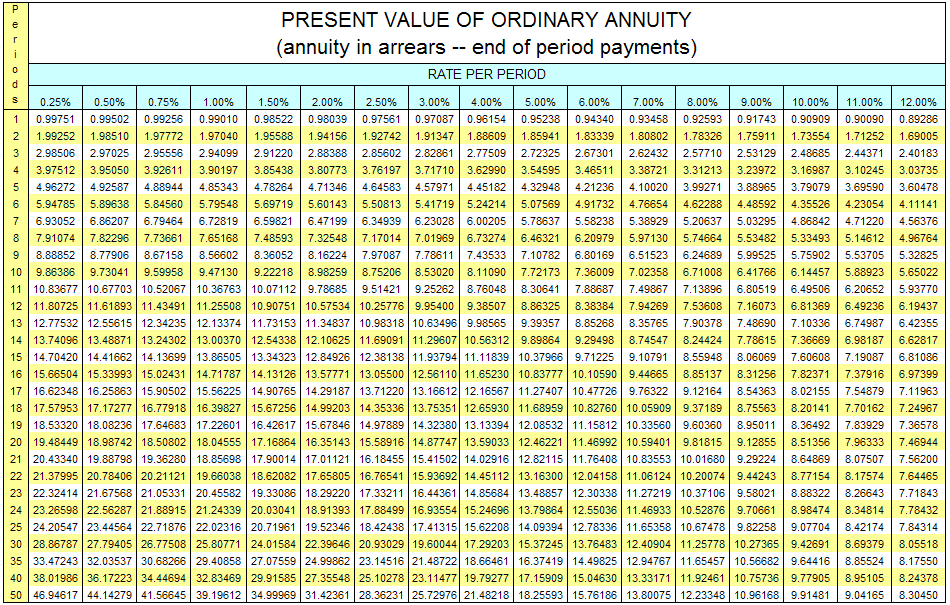

The IRS has rules for. In essence you are trading your lump sum for a guaranteed income stream. You can add funds to an annuity either gradually over time or in a single lump-sum payment.

Nonqualified annuity beneficiary options include a nonqualified stretch provision that will give. Mega Million Payout Options. That means funds may not be available for emergencies or any other use.

An annuity is a fixed amount of money that you will get each year for the rest of your life. Also known as a straight-life or life-only annuity a single-life annuity allows you to receive payments your entire life. You will need on your.

Key Differences Between Pension vs Annuity. It can cost only a dollar and end up worth more than the cost of a hundred new homes. As you might expect annuity payments that continue for the duration of two lives are going to be less than those that are for a single life.

Income payment will cease on the death of the annuitant and Death benefit ie. A pension plan is a retirement plan that requires an employer to make contributions into a pool of funds set aside for a workers future benefit. Your life has dramatically changed forever including your family and even closest friends.

A lump-sum payment is a large sum that is paid in one single payment instead of installments. Only for policies that are in-force. When a CD reaches its maturity you can take the CDs lump-sum value in cash renew the CD for the same or for a different maturity period or examine other savings alternatives such as a fixed deferred annuity.

An annuity is a contract between you and an insurance company that requires the insurer to make payments to you either immediately or in the future. A lump-sum distribution is when the beneficiary gets the remaining annuitys value in one payment similar to a CD. An individually owned nonqualified single-premium deferred fixed annuity.

Single premium deferred annuity designed to pay for long-term care expenses tax-free. In most cases the lump-sum option is clearly the way to go. The long-term care annuity multiplies the policyholder.

If thats the case then the lump-sum option is your best bet. 3 of sum assured on vesting that will get accrued for each completed policy year. Both Pension vs Annuity are popular choices in the market.

A fixed income guaranteed at the policy inception will be paid to the annuitant throughout life after deferment period is over and as per the chosen mode. Single Life Deferred Annuity for life with death benefit. However choosing a pension annuity and not deferring Social Security is not advisable.

Let us discuss some of the major Difference Between Pension vs Annuity. Once your lump-sum payment has been exchanged for periodic distributions you no longer have control or access to your money. Single or Joint Life with guaranteed payments for 5 to 30 years.

Put part of a lump sum into a fixed annuity. An annuity is a financial scheme that will pay a set amount of cash over a defined period of time whereas a pension is a retirement account that will pay cash after. Now lets say you won 100 million.

When you begin to receive payments from your annuity contract youve entered the distribution phase. This can be useful in many cases where the entire value of the account is desired immediately.

How Much Income Do Annuities Pay Due

How To Pick Your Retirement Date To Optimize Your Chevron Pension

Income Annuities Immediate And Deferred Seeking Alpha

Annuity Beneficiaries Inherited Annuities Death

What You Need To Know About A Lump Sum Life Insurance Payout Sproutt

Does An Annuity Plan Work For You Businesstoday Issue Date Mar 08 2020

Annuity Beneficiaries Inheriting An Annuity After Death

Difference Between Annuity And Lump Sum Payment Infographics

Annuity Payout Options Immediate Vs Deferred Annuities

The Cash Refund Annuity Pros And Cons 2022

Should You Take The Annuity Or The Lump Sum If You Win The Lottery

Lottery Winner S Dilemma Lump Sum Or Annuity

Lottery Payout Options Annuity Vs Lump Sum

Difference Between Annuity And Lump Sum Payment Infographics

Annuity Vs Lump Sum Top 7 Useful Differences To Know

Strategies To Maximize Pension Vs Lump Sum Decisions

Income Annuities Immediate And Deferred Seeking Alpha

When Can You Cash Out An Annuity Getting Money From An Annuity